0%

WooCommerce is one of the most popular e-commerce platforms that helps businesses build flexible and customizable online stores. One important decision you need to make when setting up a WooCommerce store is choosing the right payment gateway.

This article aims to help you learn about the top payment gateways for WooCommerce, outlining their key features as well as individual pros and cons.

What is a Payment Gateway in WooCommerce?

A payment gateway connects your WooCommerce store and the financial institutions that process your customers' payments. It securely transfers payment information from the customer to the payment processor and then returns a confirmation of the transaction.

In WooCommerce, payment gateways integrate easily with your store, allowing you to create a secure bridge between customers’ bank accounts and your merchant account. But without a reliable payment gateway, your store might face delays, transaction failures, or even data security risks.

Key Features of Good WooCommerce Payment Gateway

When you choose a payment gateway for WooCommerce, mind several critical factors:

Security Features

The protection of sensitive customer information should be your top priority. Look for gateways that comply with PCI DSS (Payment Card Industry Data Security Standard) and use encryption technologies to safeguard transactions.

User Experience

The checkout step at your store should be as smooth and intuitive as possible. A well-integrated payment gateway has to be able to simplify the payment process for customers, reducing friction and cart abandonment.

Transaction Fees and Pricing Structures

Payment gateways charge transaction fees that vary depending on the type of payment and the region. Explore and understand these fees to manage costs and determine how much each payment method impacts your margins.

Supported Payment Methods

Make sure to choose a gateway that supports multiple payment options, such as credit and debit cards, digital wallets (like Apple Pay and Google Pay), and alternative methods like bank transfers or cryptocurrency. When you offer diverse payment methods, you enhance the customer experience and increase conversion rates.

Customer Support and Documentation

Make sure to pick a payment gateway with responsive customer support and comprehensive documentation. This way, you’ll be able to quickly troubleshoot any problems, preventing them from severely impacting your store's operations.

8 Best Payment Gateways for WooCommerce

Among dozens of payment gateways for e-commerce stores, certain ones stand out for their reliability, features, and ease of use specifically with WooCommerce. Here are some of the best options to consider:

1. PayPal

PayPal is one of the most recognized payment solutions globally. It’s widely used for online transactions, and its WooCommerce integration is simple to set up.

PayPal supports both credit card and PayPal account payments, includes fraud protection, and complies with major security standards.

- Pros: Easy integration, no setup fees, trusted by customers worldwide, supports multiple currencies.

- Cons: Higher transaction fees compared to some competitors, and customers may be redirected to PayPal's site to complete the payment, which can disrupt the user experience.

2. Stripe

Stripe is another leading payment gateway, known for its flexibility and powerful API. It supports a wide range of payment methods, including credit cards, digital wallets, and even bank transfers. Stripe also offers customizable checkout solutions and integrates well with WooCommerce.

- Pros: Transparent pricing, supports many payment methods, quick and secure payments, great for developers due to API flexibility.

- Cons: Limited customer support options, slightly more technical setup.

3. Square

Square is popular for both in-person and online payments, which makes it an excellent option for businesses with both physical and digital stores. It offers a simple, flat-rate fee structure and includes a built-in point-of-sale (POS) system for businesses with brick-and-mortar locations.

- Pros: Simple pricing, easy setup, integrates well with physical stores.

- Cons: Limited to certain regions, lacks some advanced customization options.

4. Authorize.Net

Authorize.Net supports a wide range of payment options and is known for its high level of security, including advanced fraud detection and encryption.

- Pros: Strong security features, great for businesses that process large volumes of transactions and accept recurring payments.

- Cons: Higher setup and monthly fees, more complex setup process.

5. Amazon Pay

Amazon Pay provides a fast checkout experience by leveraging customer data from Amazon accounts. This not only reduces the steps required to complete a purchase, but also offers familiarity and trust.

- Pros: Fast and familiar checkout experience, trusted brand, easy integration.

- Cons: Higher fees for smaller businesses, limited to customers with Amazon accounts.

6. Payoneer

Payoneer is ideal for businesses working with international clients, especially in the B2B sector. The gateway offers global payment solutions, allowing businesses to accept payments from a wide range of countries and currencies.

- Pros: Great for international transactions, supports multiple currencies.

- Cons: Limited support for local payment methods, fees can be high for certain transfers.

7. Mollie

Mollie is a flexible payment solution that supports various payment methods, including credit cards, bank transfers, and digital wallets. It's particularly popular in Europe for supporting local payment systems.

- Pros: Great for European businesses, wide range of payment options, transparent pricing.

- Cons: Less known outside Europe, support may be regionally limited.

8. Razorpay

Razorpay is an emerging gateway with strong support in India, offering modern payment solutions for WooCommerce stores. It offers a wide array of payment options, including cards, wallets, UPI, and net banking.

- Pros: Supports many payment methods, strong presence in India.

- Cons: Limited availability outside India, evolving customer support.

Get in touch

with our expert

Discuss your project requirements and get a free estimate.

Get in touch

with our expert

Discuss your project requirements and get a free estimate.

Best Regional Payment Gateways

Apart from the global players, there are also regional payment gateways that cater to specific markets. These solutions are a great option for businesses that target a specific audience.

Asia

For businesses in Asia, gateways like Paytm (India) or AliPay (China) offer solutions tailored to the local payment preferences and systems. These gateways often support mobile payments and e-wallets, which are highly popular in these regions.

Europe

In Europe, payment gateways like Klarna and Sofort have gained popularity, particularly for offering flexible payment options like buy-now-pay-later and direct bank transfers. The above-mentioned Mollie is also a strong contender in the European market.

North America

In North America, gateways like PayPal, Stripe, and Square dominate, but options like Braintree also offer strong integrations for U.S. and Canadian markets, providing smooth processing for credit cards and digital wallets.

How to Integrate Payment Gateways with WooCommerce

To integrate a payment gateway with WooCommerce, follow this step-by-step guide:

- Install the payment gateway plugin. Most popular payment gateways offer dedicated WooCommerce plugins. Navigate to your WordPress dashboard, go to "Plugins," and search for the plugin corresponding to your selected payment gateway. Install and activate it.

- Configure the settings. After activation, go to the WooCommerce settings and find the "Payments" tab. Here, you’ll see the gateway you installed. Click on it to configure the settings, such as API keys, transaction modes (live or test), and supported payment methods.

- Test the gateway. Before going live, test the payment gateway using sandbox or test modes. Verify that transactions are processed correctly without using customers’ money.

- Go live. Once testing is complete, switch the gateway to “live mode” and start accepting real transactions. Be sure to monitor initial transactions for any issues.

Tips for Troubleshooting Payment Gateway Issues:

- Ensure that all required API credentials are correct.

- Clear your site’s cache if you’re experiencing payment errors.

- Check the WooCommerce logs for any transaction-related errors.

- Reach out to the payment gateway’s customer support if issues persist.

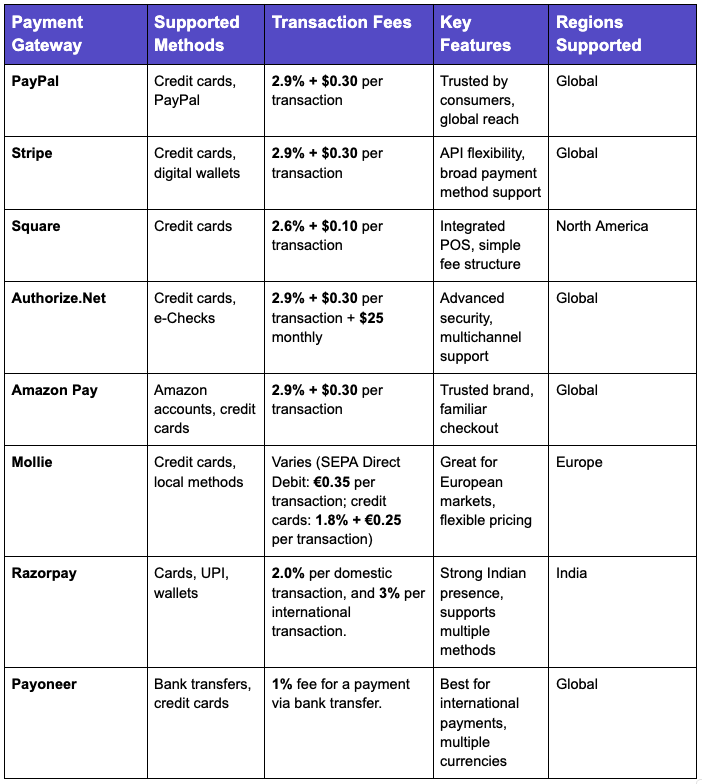

Comparison of 8 Best Payment Gateways

To help you make an informed decision, here's a comparison of the key features, fees, and supported payment methods for the 8 top payment gateways mentioned above:

FAQs

What is the best payment gateway for small businesses?

PayPal is a common choice for small businesses because of its ease of setup and global acceptance. Stripe is also excellent for flexibility and scalability, especially for online-only businesses.

How do I choose the right payment gateway for my WooCommerce store?

To choose the right payment gateway, consider factors like transaction fees, security features, supported payment methods, and ease of integration. Think about where your customers are located and the payment methods they prefer.

Are payment gateways secure for online transactions?

Yes, most payment gateways comply with PCI DSS standards and use encryption to protect customer data. However, it's important to choose a reputable provider with strong security measures in place.

What are the fees associated with payment gateways?

The fees associated with payment gateways vary by provider and transaction type. Most gateways charge a percentage of the transaction amount, plus a fixed fee per transaction. There may also be additional charges for currency conversion, refunds, or chargebacks.

Can I use multiple payment gateways in WooCommerce?

Yes, WooCommerce allows you to use multiple payment gateways simultaneously. This lets you offer your customers different options, which can improve conversion rates and cater to diverse preferences.

On a Final Note

Selecting a suitable payment gateway for your WooCommerce store is a key step in shaping both your business operations and customer experience. To make the right decision, evaluate such factors as:

- Security

- Supported regions

- Customer support reactivity

- Transaction fees

If you need further assistance in selecting or integrating a payment gateway with your WooCommerce store, Transform Agency is here to help. Our experts can guide you through the process or take over the integration process, ensuring a secure setup.

A seasoned product manager specializing in e-commerce, Helen excels in market analysis and strategic marketing for Magento platforms.

A seasoned product manager specializing in e-commerce, Helen excels in market analysis and strategic marketing for Magento platforms.